Staying ahead of tax deadlines is one of the simplest ways to keep your business financially healthy. Missing a filing or payment deadline can result in penalties, interest, and unnecessary cash flow strain.

Whether you operate as a sole proprietor, partnership, S corporation, or C corporation, your tax calendar will differ. This overview highlights the most important federal tax deadlines for 2026 so you can plan ahead and stay focused on running your business.

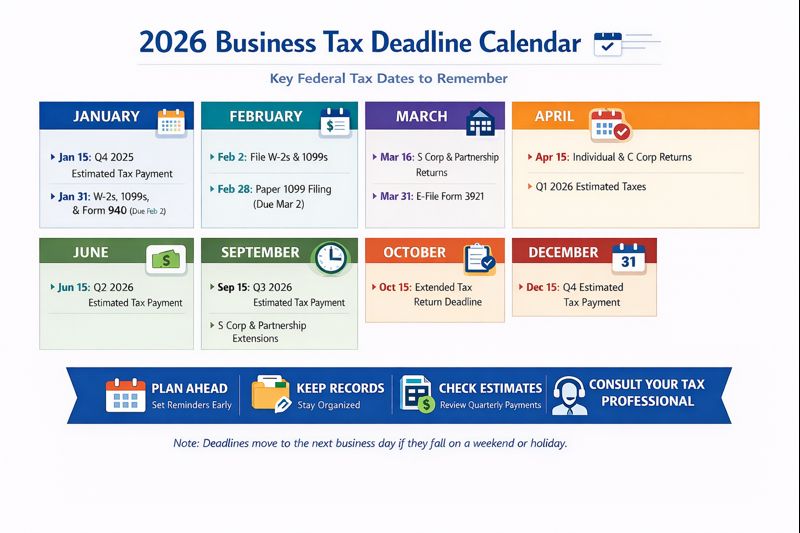

Key Federal Tax Deadlines for 2026

Note: These are federal deadlines only. State and local filing requirements may differ. When a due date falls on a weekend or federal holiday, the deadline moves to the next business day.

January 2026

January 15

- Fourth quarter 2025 estimated tax payment due (Form 1040-ES)

January 31 (Saturday → February 2, 2026)

- W-2 forms due to employees

- 1099 forms due to contractors

- Copy B of Form 3921 due to employees (ISO exercises)

- Form 940 (Federal Unemployment Tax Return) due

February 2026

February 2

- File W-2 and 1099 forms with the Social Security Administration

- Provide Affordable Care Act (ACA) forms to employees

February 28 (Saturday → March 2, 2026)

- Paper filing deadline for Forms 1099-MISC, 1099-NEC, and W-2

- Paper filing deadline for Form 3921

March 2026

March 16 (March 15 is Sunday)

- S corporation (Form 1120-S) and partnership (Form 1065) returns due

- Schedule K-1s due to shareholders and partners

- Deadline to elect S corporation status for 2026 (Form 2553)

March 31

- Electronic filing deadline for Form 3921

April 2026

April 15

- Individual (Form 1040) and C corporation (Form 1120) returns due

- First quarter 2026 estimated tax payment due

- Deadline to request an automatic extension (Forms 4868 or 7004)

June 2026

June 15

- Second quarter 2026 estimated tax payment due

September 2026

September 15

- Third quarter 2026 estimated tax payment due

- Extended deadline for S corporation and partnership returns

October 2026

October 15

- Extended deadline for individual and C corporation returns

December 2026

December 15

- Fourth quarter estimated tax payment due for calendar-year corporations

January 2027

January 15

- Final estimated tax payment for fourth quarter 2026 due

Tips to Stay Ahead of Tax Deadlines

Managing your tax calendar doesn’t have to be overwhelming. A few proactive habits can make a significant difference:

- Set automated reminders for key filing and payment dates

- Maintain up-to-date records, including W-9s, receipts, and payroll reports

- Review estimated tax payments regularly, especially if income fluctuates

- Coordinate with your tax advisor to confirm which deadlines apply to your entity

- Monitor state-specific requirements, including income, franchise, and sales tax filings

How We Can Help

Tax planning shouldn’t be limited to filing season. We work with businesses year-round to align compliance, planning, and cash flow with long-term goals. From quarterly estimates and entity planning to filings and extensions, we help simplify the process and keep you on track.

Contact us to build a proactive tax strategy that keeps you ahead of every deadline.